2024 Irs Schedule 590 B – “Publication 590-B, Distributions from Individual “Instructions for Schedule A,” Page 12. Internal Revenue Service. “Tax Basics: Understanding the Difference Between Standard and Itemized . Convinced of this, I cleared my schedule to study the bill and the took those distributions didn’t matter. IRS Publication 590-b reinforced this point. However, in February 2022, the IRS .

2024 Irs Schedule 590 B

Source : www.irs.gov2022 Publication 590 B

Source : www.irs.govAbout Publication 590 B, Distributions from Individual Retirement

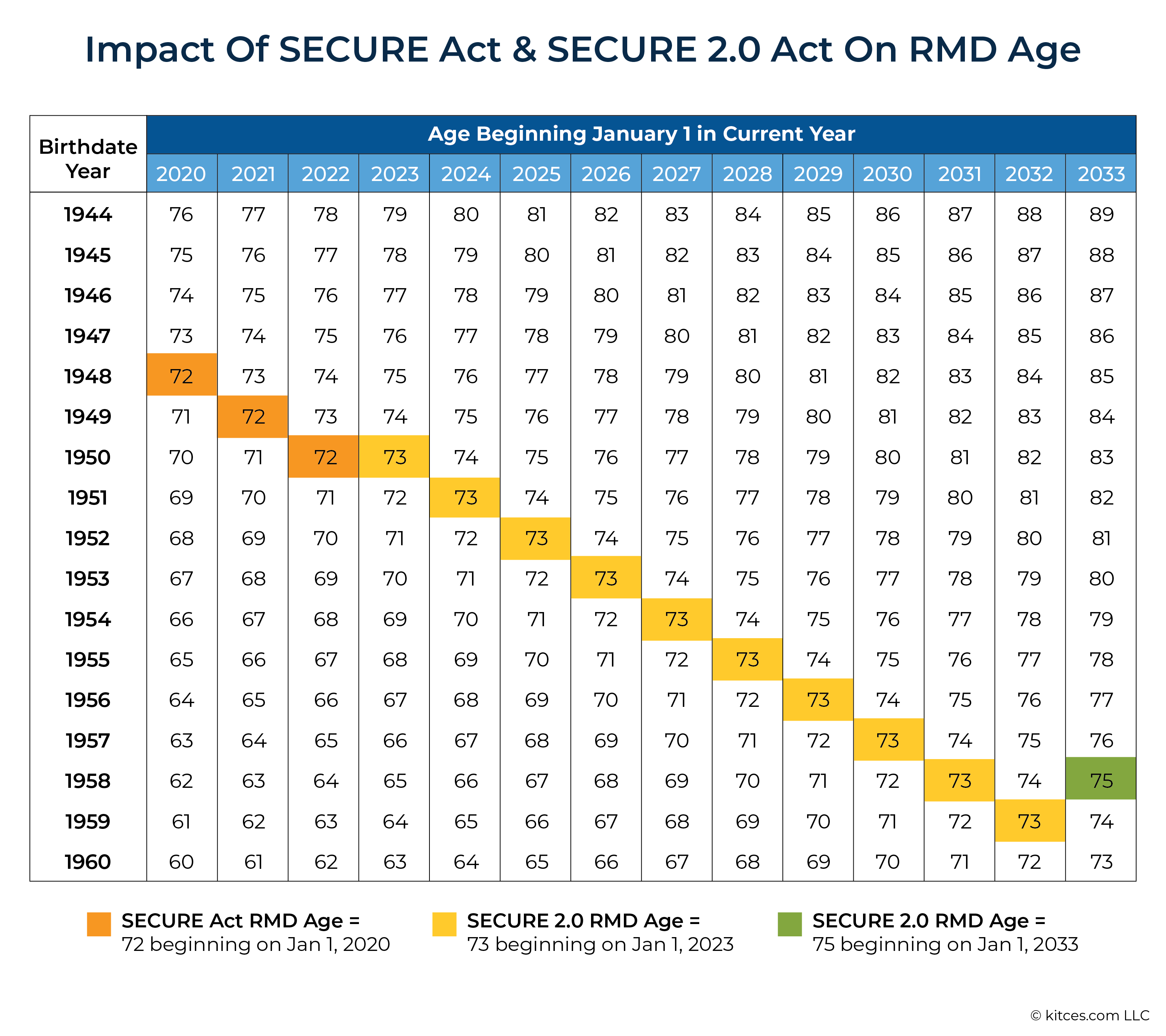

Source : www.irs.govIRS Notice 2023 54 Provides Relief, Guidance Regarding RMDs

Source : www.kitces.comPublication 590 B (2022), Distributions from Individual Retirement

Source : www.irs.govIRS Clarifies 10 Year RMD Rule and Pub. 590 B | Wolters Kluwer

Source : www.wolterskluwer.comPublication 590 B (2022), Distributions from Individual Retirement

Source : www.irs.govTaxes For Dummies: 2024 Edition: Tyson, Eric, Munro, Margaret A

Source : www.amazon.com1040 (2023) | Internal Revenue Service

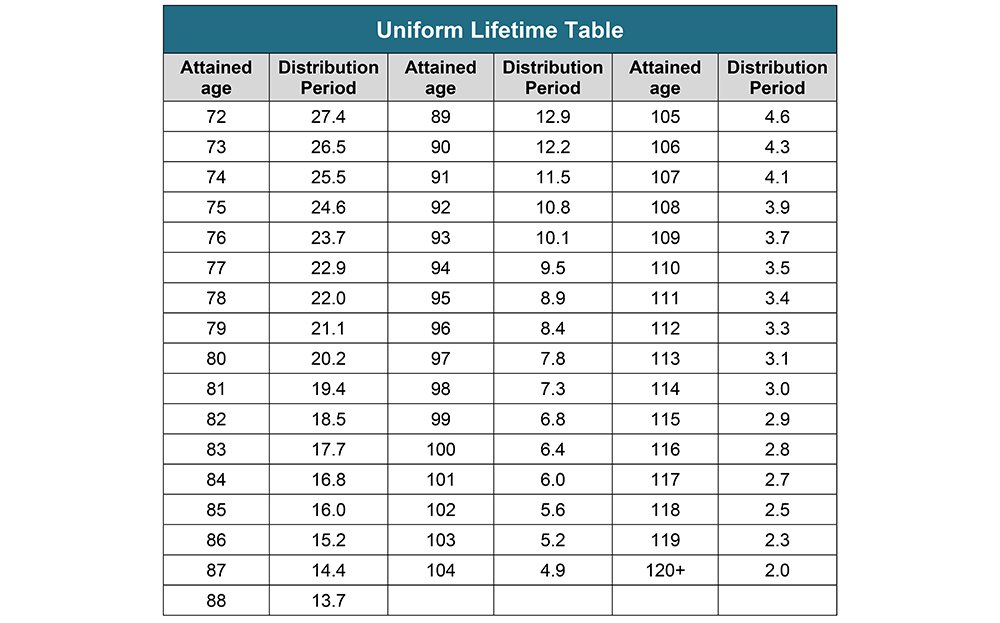

Source : www.irs.govYour Search for the New Life Expectancy Tables is Over — Ascensus

Source : thelink.ascensus.com2024 Irs Schedule 590 B Publication 590 B (2022), Distributions from Individual Retirement : The IRS typically tells taxpayers it will take 21 days to receive their refund after filing. However, that time frame can be shortened to two weeks by making minor adjustments to how you file . Q. My husband passed away in January 2024, two weeks away from his 73rd birthday. I am 65, disabled and receiving disability payments from Social Security. My husband had a 401(k) plan in which I was .

]]>