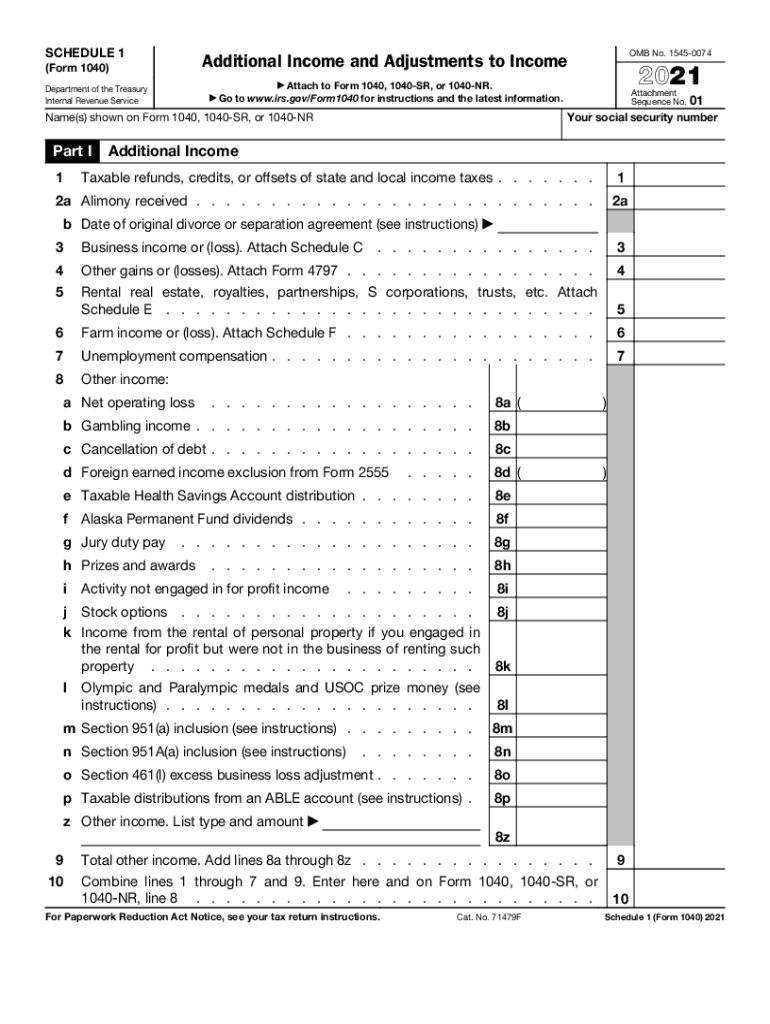

Irs 2024 Schedule 1 Instructions 1040 – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024 on the standard Form 1040. It includes sections for . These limits are noted in the table below for both the 2023 and 2024 Internal Revenue Service. “Schedule C: Profit or Loss from Business,” Page 1. Internal Revenue Service. “2022 Instructions .

Irs 2024 Schedule 1 Instructions 1040

Source : www.irs.govInstructions for 1040 and 1040 SR: Including the instructions for

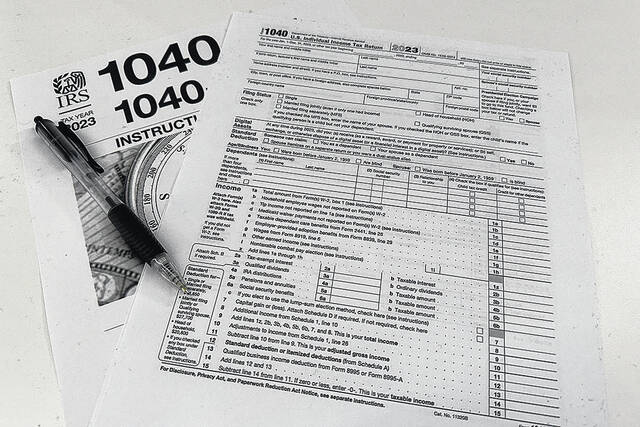

Source : www.amazon.com1040 (2023) | Internal Revenue Service

Source : www.irs.govAmazon.com: 1040 U.S. Individual Income Tax Return 2023: includes

Source : www.amazon.comAP | Tax season is under way so how do we navigate? | Laurinburg

Source : www.laurinburgexchange.com2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.comAmazon.com: 1040 U.S. Individual Income Tax Return 2023: includes

Source : www.amazon.comSOLUTION: 2020 Schedule 1 Form 1040 Studypool

Source : www.studypool.comWhat is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIrs 2024 Schedule 1 Instructions 1040 1040 (2023) | Internal Revenue Service: The IRS is planning a threshold of $5,000 for tax year 2024. A 1099-DIV is the “other income” line of a 1040 form, which is reported on line 8 of Schedule 1. There’s no perfect solution . It’s an unusual time of year for people who pay attention to their taxes—possibly catching you with two goals in mind. On the one hand, you’re worried about preparing and filing your tax return for .

]]>